Keeping an eye on Profitability

We are a dedicated firm of Chartered Accountants, committed to supporting businesses and households with professional expertise and personalised service.

Clear Start Accountants are trusted by over 6,000+ satisfied customers.

4.8

4,117 reviews

Empowering You with Financial Clarity.

At Clear Start Accountants, we specialise in providing expert financial guidance tailored to your business and household needs. Whether you are a start-up or an established company, our team is committed to helping you achieve your financial goals with precision and confidence..

Contact Us 0161 518 6795Our full range of accountancy services.

Save your precious time and effort spent for finding a solution. Contact us now

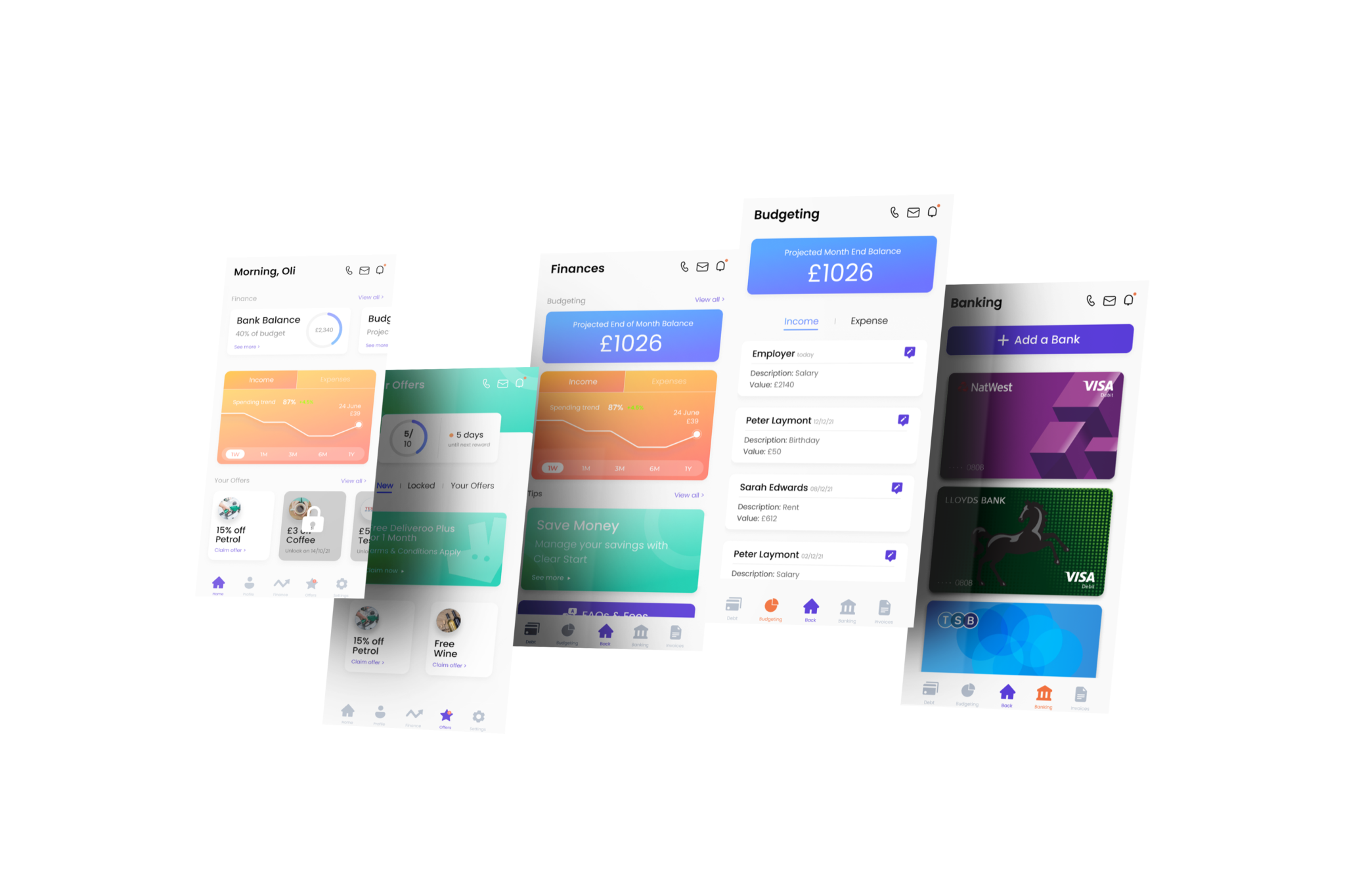

Download our App.

Manage your account, update personal information.

We are constantly updating our app with money saving tips and offers.

Securly upload documents to the app without having to pick up the phone to our team.